: If you've funded your lorry, your lending institution may need certain types of protection and also limitations on deductible amounts. car. While you may be able to pay for a greater insurance deductible, your lending institution might not allow it.: If you have actually gotten in numerous accidents in the current past, you could be at a greater risk of getting in another one, and a reduced insurance deductible may be a better alternative.

There's no one-size-fits-all remedy for everybody, so it is necessary to take into consideration these aspects and other facets of your circumstance to pick the best insurance deductible for you. Other Ways to Minimize Vehicle Insurance, Picking the best deductible can offer you a good balance in between conserving on your month-to-month rate as well as the quantity you owe when you sue - risks.

Various other means to conserve on car insurance policy consist of: Shopping around and also comparing quotes from numerous insurance firms, Using discounts that you qualify for, Making modifications to coverage amounts, Improving your credit report, Insurance policy companies in the majority of states utilize your credit score record to create what's called a credit-based insurance rating - auto insurance. They then use this rating to aid determine your price.

When it comes to cars and truck insurance, a deductible is the quantity you 'd have to pay out of pocket after a protected loss prior to your insurance coverage kicks in. Car insurance deductibles work in different ways than clinical insurance coverage deductibles with vehicle insurance, not all sorts of protection need a deductible. Liability insurance doesn't call for an insurance deductible, but extensive as well as collision insurance coverage typically do.

When you're including that coverage to your auto insurance coverage plan, you'll generally have the chance to decide where you wish to set the insurance deductible. Generally, the higher you set your insurance deductible, the reduced your month-to-month insurance policy costs will be however you do not intend to establish it so high that you wouldn't be able to in fact pay that quantity if required. car insurance.

6 Easy Facts About How To Choose Your Car Insurance Deductible - The Balance Described

What does a car insurance deductible mean? A insurance deductible is the amount of money you have to pay of pocket prior to your auto insurance coverage will certainly cover the remainder - insurance affordable. If you backed your auto into a telephone post, your accident insurance would pay for the expense of the damage.

If the complete price of repair services involves $1800, your insurance will only pay for $1300. You can find your insurance deductible quantities is detailed on your affirmations page. Having to pay an insurance deductible means you can do a kind of cost-benefit analysis prior to you make a case with your insurance firm.

We don't market your details to 3rd parties. What kind of insurance coverage requires a deductible? Not all kinds of car insurance policy protection need an insurance deductible. Liability insurance policy, which covers the expenses if you harm somebody's building or harm someone with your vehicle, never ever calls for an insurance deductible. Responsibility coverage is the backbone of the majority of car insurance plan, and also in many states in the united state, you're called for by legislation to have it.

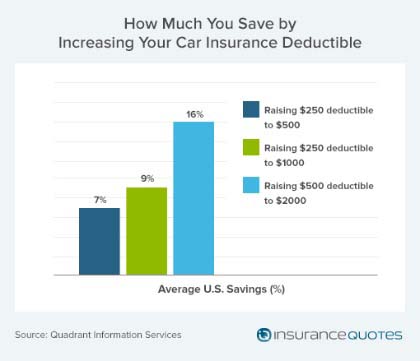

Accident insurance coverage covers damages to your auto from an accident, no matter that was at mistake. Both crash and compensation insurance coverage generally need that you pay an out-of-pocket deductible however you choose the amount, and where you set your deductible will have an affect on your month-to-month insurance policy premium - laws. Exactly how do I determine what my insurance deductible should be? Typically, the greater you set your insurance deductible, the lower your monthly premiums.

The reverse is additionally true, selecting a reduced insurance deductible ways you'll have to pay a greater premium. You might be tempted to pick a high deductible so as to get a lower insurance coverage costs, however remember, there's an extremely actual possibility you'll have to pay that deductible someday. When choosing an insurance deductible, make certain it's an amount you 'd actually have on hand if you needed Hop over to this website to pay it.

Getting The What Is A Car Insurance Deductible? - Credit Karma To Work

The vehicle insurance deductible is the quantity of cash you will first be accountable for prior to the insurance provider begins to cover expenses - vehicle. Unlike wellness insurance policy, auto insurance coverage deductibles are generally on a per insurance claim basis definition you would need to cover these expenses each time you sue.

does not cover the damages you caused to various other people's home Covers damage done to your vehicle in all circumstances various other than a collision in which you are at fault. This consists of points like dropping tree arm or legs, or any kind of other kinds of damage that your automobile may incur. Just how does the deductible job? Your insurance deductible, typically around $750 will be first related to any type of damages. car.

The staying $2,750 would certainly then be covered via the collision coverage by your insurance company. Sometimes where an additional vehicle driver is at mistake for the accident you may wish to submit a third-party insurance claim against their Under these circumstances your insurance company may go after a procedure called subrogation to redeem the quantities they have actually currently paid (insurance company).

It is also important to keep in mind that given that car insurance coverage deductibles get on a per-claim basis so the regularity of your claims will certainly be just one of the most vital variables (cheap). If your plan has a $500 insurance deductible as well as you were associated with 4 different claims of much less than $500, then you would certainly be responsible for 100% of all the repayments and your insurance coverage would have given no protection.

One method you can take is to consider your driving and automobile background. If your background suggests that you might need to make more frequent claims, you may wish to consider picking a policy with reduced expense expenditures. On the various other hand, if you haven't had a background of mishaps you might not need a reduced deductible strategy.

7 Simple Techniques For High Or Low Car Insurance Deductible - Compare.com

Whether you're a new chauffeur or have been behind the wheel for many years, it can be daunting to wade through insurance terms like "deductible." Your car insurance policy deductible affects the price of your insurance policy, so it's vital that you select one very carefully. The insurance deductible that's right for you depends upon your private scenarios.

If you require to submit an insurance claim with your auto insurance service provider after a mishap, or when your car is otherwise damaged, there's a likelihood you'll require to pay a deductible. So, how does a deductible work? A deductible is the quantity of cash you pay of pocket prior to your insurance protection starts as well as begins spending for the prices of your loss.

Not all insurance coverage coverages need an insurance deductible, however if your own does, you'll choose the amount. Your insurance deductible will impact your regular monthly insurance coverage repayment the lower your deductible, the higher your automobile insurance costs. When searching for quotes from cars and truck insurance coverage business, trying out just how different deductibles will impact your monthly settlements.

Automobile insurance policies can consist of different types of insurance coverage that serve differing functions, as well as you can choose to be covered by some or every one of them. A few of these coverage options need deductibles and some do not, so it's worth noting what deductibles you'll be required to pay. State regulation typically figures out whether or not an insurance deductible is needed. laws.

This covers you if your car collides with one more vehicle or object and you need to spend for repairs. Crash deductibles are conventional yet differ by insurance provider. If your vehicle is harmed by an occasion such as fire, a falling item striking your windshield or criminal damage, you'll submit a comprehensive protection insurance policy case (car insurance).

The Ultimate Guide To Collision Or Comprehensive Deductible? - Florida Insurance

Deductibles are occasionally needed for this insurance coverage, however not always, and demands differ by state. While your vehicle insurance policy deductible can differ considerably depending on many aspects, including exactly how much you want to pay, car insurance coverage deductibles commonly vary from $100 to $2,500 (business insurance).

When picking an insurance deductible, you'll require to take into consideration numerous aspects, including your budget plan. Spend some time computing just how much you can manage to spend for a deductible and exactly how much you'll minimize your regular monthly costs by choosing a higher one - insurance companies. Ask yourself these questions when choosing a deductible amount.

You need this buffer in case the worst occurs, yet if you're a risk-free motorist or don't drive commonly, making use of a reserve to cover any crashes might be an option. This is a vital question when considering what insurance deductible to pick. If you enter an accident, can you manage the deductible or would you have a hard time to pay it? Taking on a high deductible might not make much sense if it represents a huge section of the automobile's value.

Insurance policy providers use deductibles to assist lower their threat involving you, the insured event. What Is a Car Insurance Policy Deductible?

Not all car insurance policy protection needs a deductible, yet you will commonly discover a insurance deductible is called for for the list below kinds of insurance coverage, according to Progressive: Comprehensive, Accident, Accident defense, Uninsured/underinsured vehicle driver, The deductible will work the very same way despite the insurance coverage type and will be needed any time you make an insurance claim (cars).

Not known Details About What Is A Disappearing Deductible? - Mapfre Insurance

Comprehensive insurance covers points that do not involve an additional driver. You might additionally need to pay your deductible if your windshield is broken, although some insurance coverage companies do offer full glass coverage as a choice. Are There Times When No Deductible Is Called for? There are circumstances in which no insurance deductible will certainly be needed.

So even though you triggered the accident, you don't have to pay anything expense when a person makes a claim versus your liability insurance coverage for damages you trigger to their residential or commercial property or for injuries. Various other scenarios where you won't be required to pay a deductible include: An insured driver hits you.

You go with cost-free repair services on your glass. Being associated with a crash with one more insured driver, where the crash is deemed their fault, suggests you will not have to pay an insurance deductible due to the fact that you'll be making an insurance claim with their obligation insurance. You do have the alternative to make an insurance claim with your very own crash coverage, if you have it.

When getting in touch with Allstate, we discovered out that, depending upon the state you live in and also the insurance policy service provider you make use of, there is a zero-deductible option available. Of course, choosing a zero-deductible choice on your insurance coverage will likely cause a higher regular monthly costs. This is due to the fact that all the threat is currently presumed by the insurer.

The finest amount for you will depend on your monetary scenario due to the fact that your insurance deductible influences your monthly premium rate. Progressive recommends that you maintain this in mind when determining what total up to set for your insurance deductible: A greater insurance deductible indicates a reduced monthly premium, however a higher out-of-pocket expense when making a case.

The 5-Second Trick For What Does Deductible Mean In Car Insurance? - Car And Driver

Understanding what your automobile insurance deductible is and also when you need to pay it is an important facet of choosing what kind of insurance policy coverage you desire. Make certain you'll be able to cover the deductible quantity when you make a case to your insurance firm to stay clear of any problems with obtaining repairs taken care of in a timely way (vehicle insurance).

For any type of feedback or correction demands please contact us at. Sources: This content is developed and also preserved by a 3rd party, and also imported onto this web page to assist users supply their email addresses. You might have the ability to find more info concerning this as well as comparable web content at (dui).